Irs Brackets 2025 Married Jointly - Irs Tax Brackets 2025 Married Jointly Latest News Update, See current federal tax brackets and rates based on your income and filing status. Married filing jointly married filing separately head of household; Married, filing jointly married, filing separately.

Irs Tax Brackets 2025 Married Jointly Latest News Update, See current federal tax brackets and rates based on your income and filing status. Married filing jointly married filing separately head of household;

Es Seguro Viajar A Nicaragua 2025. Nicaragua es un país relativamente seguro para viajar, aunque […]

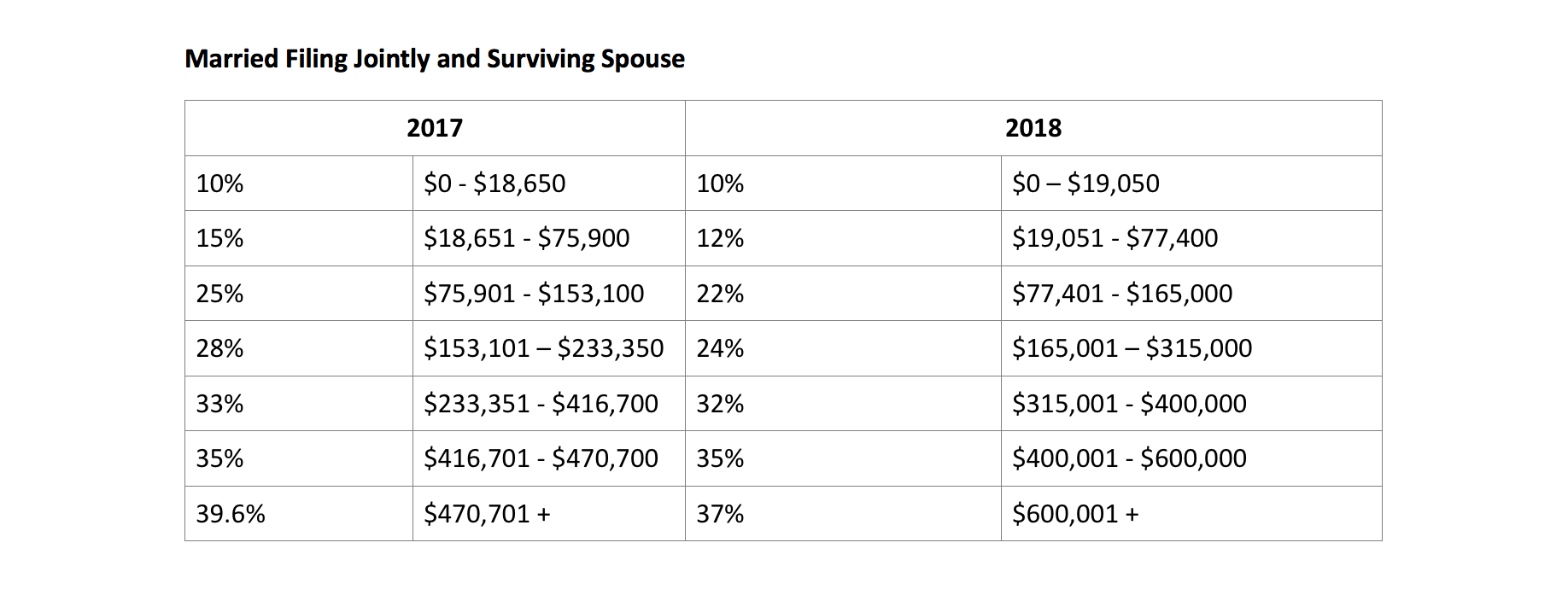

Irs Brackets 2025 Married Jointly. The tax rates continue to increase as someone’s income moves into higher brackets. You pay tax as a percentage of your income in layers called tax brackets.

2025 Tax Brackets Married Filing Separately 2025 Manda Jennie, 10% for incomes of single individuals with incomes of $11,600 or less ($23,200 for married couples filing jointly) 12% for incomes over $11,600 ($23,200 for. The standard deduction for couples filing jointly is $29,200 in 2025, up from $27,700 in the 2023 tax year.

37% for individual single taxpayers with incomes greater than $609,350 and for married couples.

Tax Brackets 2025 Irs Single Elana Harmony, 22% for incomes over $47,150 ($94,300 for married couples filing jointly) 12% for incomes over $11,600 ($23,200 for married couples filing jointly) personal. The irs uses different federal income tax brackets and ranges depending on.

Tax Brackets 2025 Married Jointly Norri Annmarie, The standard deduction for couples filing jointly is $29,200 in 2025, up from $27,700 in the 2023 tax year. Tax brackets for married couples filing jointly —$23,200 or less in taxable income — 10% of taxable income —$23,200 but not over $94,300 — $2,320 plus 12% of the excess.

2025 Tax Brackets Married Jointly Glenn Kalinda, The irs released these brackets and income levels for 2025: Single filers and married couples filing jointly;

How to fill out IRS Form W4 Married Filing Jointly 2025 YouTube, 10% for incomes of single individuals with incomes of $11,600 or less ($23,200 for married couples filing jointly) 12% for incomes over $11,600 ($23,200 for. The tax rates continue to increase as someone’s income moves into higher brackets.

You pay tax as a percentage of your income in layers called tax brackets.

The irs released these brackets and income levels for 2025: The irs increased its tax brackets by about 5.4% for each type of tax filer for 2025, such as those filing separately or as married couples.